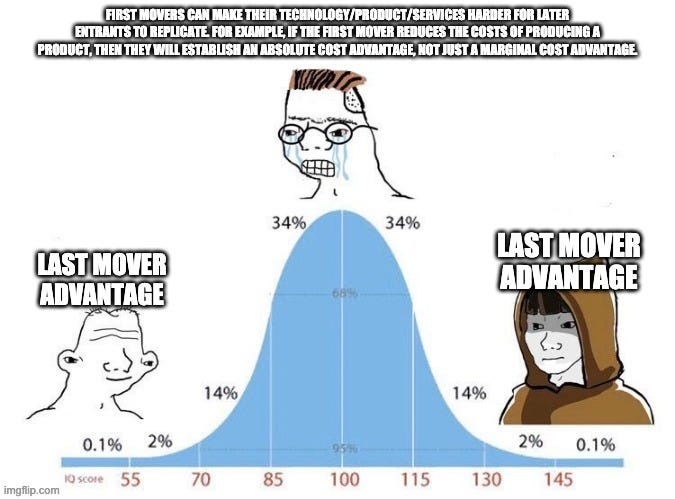

Last Mover Advantage

"First mover" is a label, not an outcome

First Mover Advantage has a cachet that it has rightly earned. It's an edge that we've all come to appreciate ever since we raced our fellow kindergarteners to the coolest swing on the swing set.

And it's a distinctly American concept. Researchers have found that the concept of First Mover Advantage is held up more highly by Americans than it is by Chinese. From airplanes to Airbnb, America is the first-mover country and it has served us well.

Why First Mover Advantage works is not hard to explain: the first mover can:

Register IP to box out would-be competitors

Create long-lasting brand recognition and an association as the "best"

Control resources (i.e. valuable partnerships or a lasting advantage in attracting talent)

Protect themselves by using or creating high switching costs

Google has employed all these strategies with striking execution. But here's the catch: they weren't the first mover. In fact, they were far from it.

First Mover Advantage is not a magic bullet.

For investors and founders alike, we need to understand—as Peter Thiel explains—that being first mover is not an outcome, but rather just a strategy.

In fact, every intelligent first mover strategy aims at one singular outcome: become the last mover. A well-capitalized tech company will not adequately return its investment unless it achieves some form of last-mover status.

Company valuations are based almost entirely on the future profit potential of the business. Peter Thiel explains that for most tech companies this potential is realized ten or twenty years into the future. So while first mover advantage is surely worth paying attention to, it is always subject to the bigger question: "will this company still be successful ten years from now?"